This is an opportunity not seen in the last 20 years...

Don't miss out on the great annuity refinancing opening of 2025

Leverage higher interest rates to your advantage. An annuity refinance could help you lock in higher initial bonuses, create greater growth opportunities, and secure a source of guaranteed lifetime income with a fixed indexed annuity (FIA).1

How It works:

- Schedule your complimentary meeting with one of our advisors.

- Review your current annuity contract on an initial zoom meeting.

- Your advisor will analyze your current annuity and compare it to the new options that are available and make recommendations for your specific situation.

Schedule Your Free Appointment Now"Our clients best interest is our top priority. If WE can help you or not we always strive for transparency and keeping their needs first." - Gabriel Rodriguez

Who WE are..

WE Annuity Refinance is a program developed by the Founder & CEO of WE Alliance Wealth Advisors Inc. , Terry Wheeler J.D. , CFP®. WE Alliance Wealth Advisors Inc. is a fiduciary-based RIA in Roseville California. Through WE Annuity Refinance Terry and his team of independent advisors will analyze your existing contract with a complimentary review. With your best interest as top priority your contract will be compared to the best options available today. The team dives deep to help you understand if refinancing makes sense for your situation.

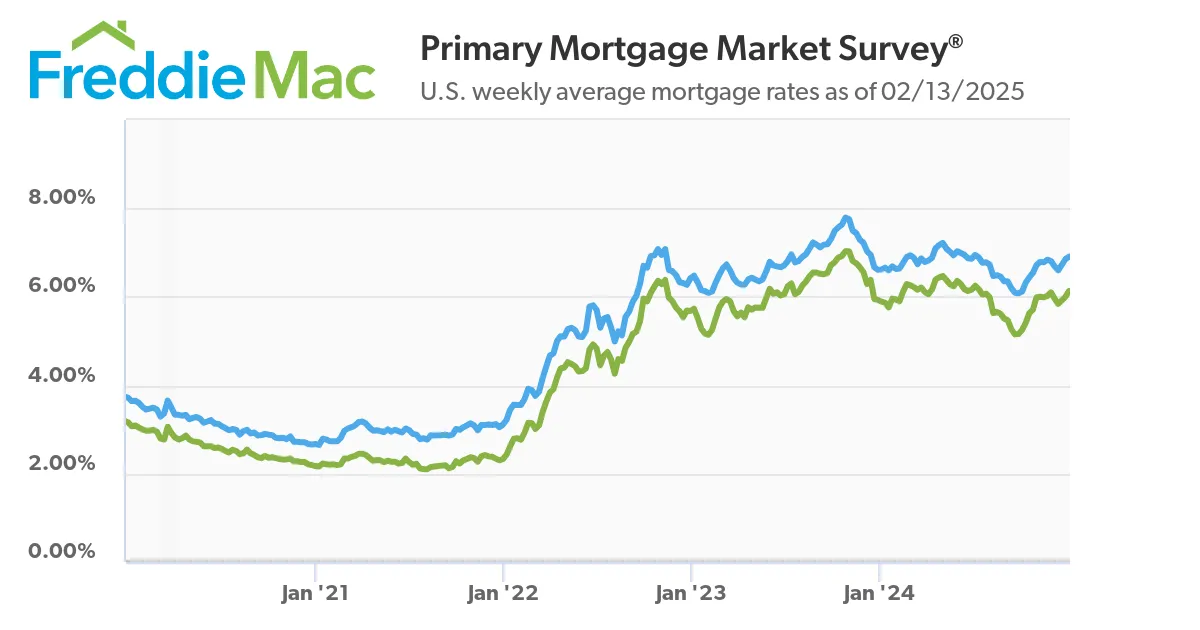

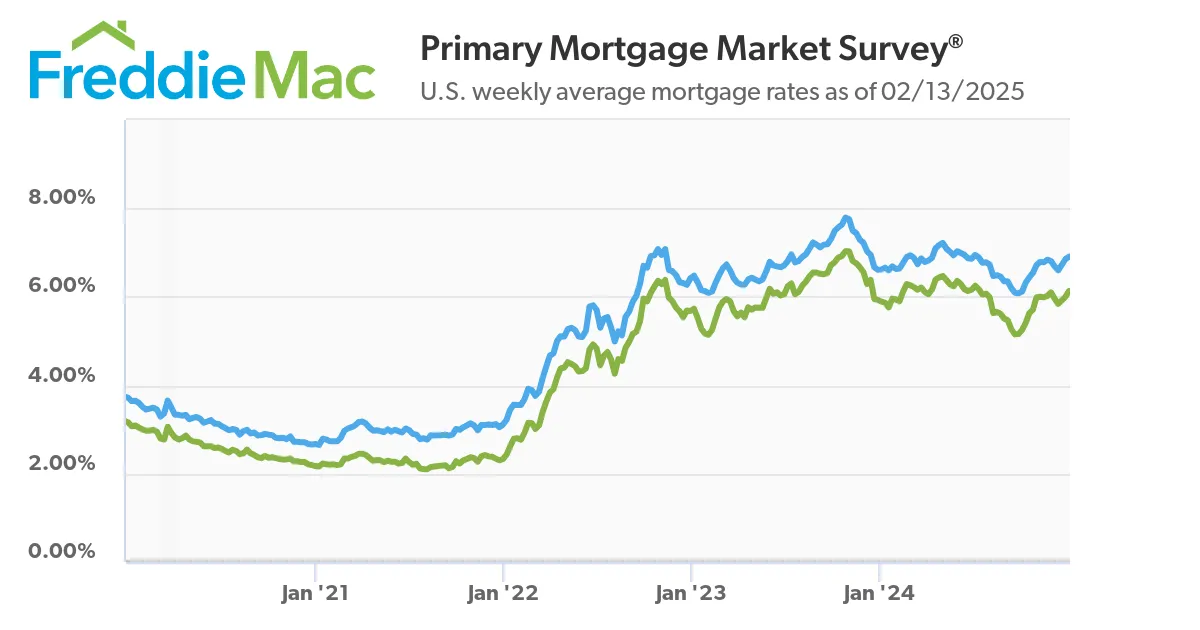

Declining rates drove mortgage refinancing

Interest rates dropped steadily from 2000 to 2021, causing homeowners to rush to refinance their mortgages and save on monthly payments

Since 2020, interest rates have risen over 400%

Over the last four years, interest rates have risen substantially, creating a unique opportunity for retirees seeking to optimize their retirement plans.

Since 2020, interest rates have risen over 400%

Over the last four years, interest rates have risen substantially, creating a unique opportunity for retirees seeking to optimize their retirement plans.

While today’s high interest rates aren’t ideal for mortgage refinancing, annuity policyholders can take advantage of the higher rates to “refinance” their retirement plans for the better.

3 Potential Benefits Of Upgrading Your Fixed Indexed Annuity

Significantly Higher Participation Rates2

The Participation Rate is the percentage of the index return that gets credited to a Fixed Indexed Annuity (FIA) contract. Today’s FIA participation rates are much higher than in the past. On some products, you can now receive up to 200%–350%, meaning the annuity could credit 2-3.5 times the index return.4

Premium Bonuses are at Record-High Levels3

A premium bonus is immediately credited to your contract when you purchase the annuity and is based on a percentage of your premium deposit. Today’s initial premium bonuses are 10-20%, some of the highest in the history of fixed indexed annuities

Generate Guaranteed Income For Life1

Many people need more than Social Security and savings to provide for their daily needs in retirement. Annuities are unique in that they are one of the only products that can provide guaranteed income for life no matter how long you live. Today’s Income Base Bonuses can be as high as 30% and the guaranteed annual roll-up rates are up to 8%

Securities and Advisory Services offered through WE Alliance Wealth Advisors, Inc., a Registered Investment Advisor.

CA Insurance License #0A89858

Disclosure

WARRANTIES & DISCLAIMERS There are no warranties implied.

WE Alliance Wealth Advisors, Inc. is a registered investment adviser located in Roseville, CA. WE Alliance Wealth Advisors, Inc. may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. WE Alliance Wealth Advisors, Inc.’s web site is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Accordingly, the publication of WE Alliance Wealth Advisors, Inc.’s web site on the Internet should not be construed by any consumer and/or prospective client as WE Alliance Wealth Advisors, Inc.’s solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet. Any subsequent, direct communication by WE Alliance Wealth Advisors, Inc. with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of WE Alliance Wealth Advisors, Inc., please contact the state securities regulators for those states in which WE Alliance Wealth Advisors, Inc. maintains a registration filing. A copy of WE Alliance Wealth Advisors, Inc.’s current written disclosure statement discussing WE Alliance Wealth Advisors, Inc.’s business operations, services, and fees is available at the SEC’s investment adviser public information website – www.adviserinfo.sec.gov or from WE Alliance Wealth Advisors, Inc. upon written request. WE Alliance Wealth Advisors, Inc. does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to WE Alliance Wealth Advisors, Inc.’s web site or incorporated herein, and takes no responsibility therefor. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. This website and information are provided for guidance and information purposes only. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy. This website and information are not intended to provide investment, tax, or legal advice.