Fully integrated, nationally-recognized wealth management.

Your trusted partners for over 30 years.

Proudly providing client-first wealth education in portfolio management, wealth accumulation, and tax and estate planning for over 30 years.

Students of our comprehensive financial education:

Committed to lifelong learning and building client-first strategies:

Meet Our Founder & CEO Terry Wheeler

You're Age 50+

You have over $500,000 in Retirement Savings

But You Have a Questions

?

"How do I reduce my taxes in retirement?"

?

"Are my investments going to sustain me throughout my retirement?"

?

"How do I protect my portfolio when markets crash?"

Podcast ( We Money Talk with Terry)

Get Started in 3 Easy Steps

Step #1

Get your no-cost retirement evaluation meeting

This meeting is all about you. Using our D.O.S. system, discover how we tailor retirement plans based on your unique financial needs, goals, and values. Available through zoom or in person in our offices.

Step #2

Review your plan

Analyze your unique retirement planning and assessment results to see if we’re the right fit for you.

Step #3

Enlist our expertise.

Join the WE Alliance family and hire us to handle the heavy lifting–so you can enjoy the retirement you deserve.

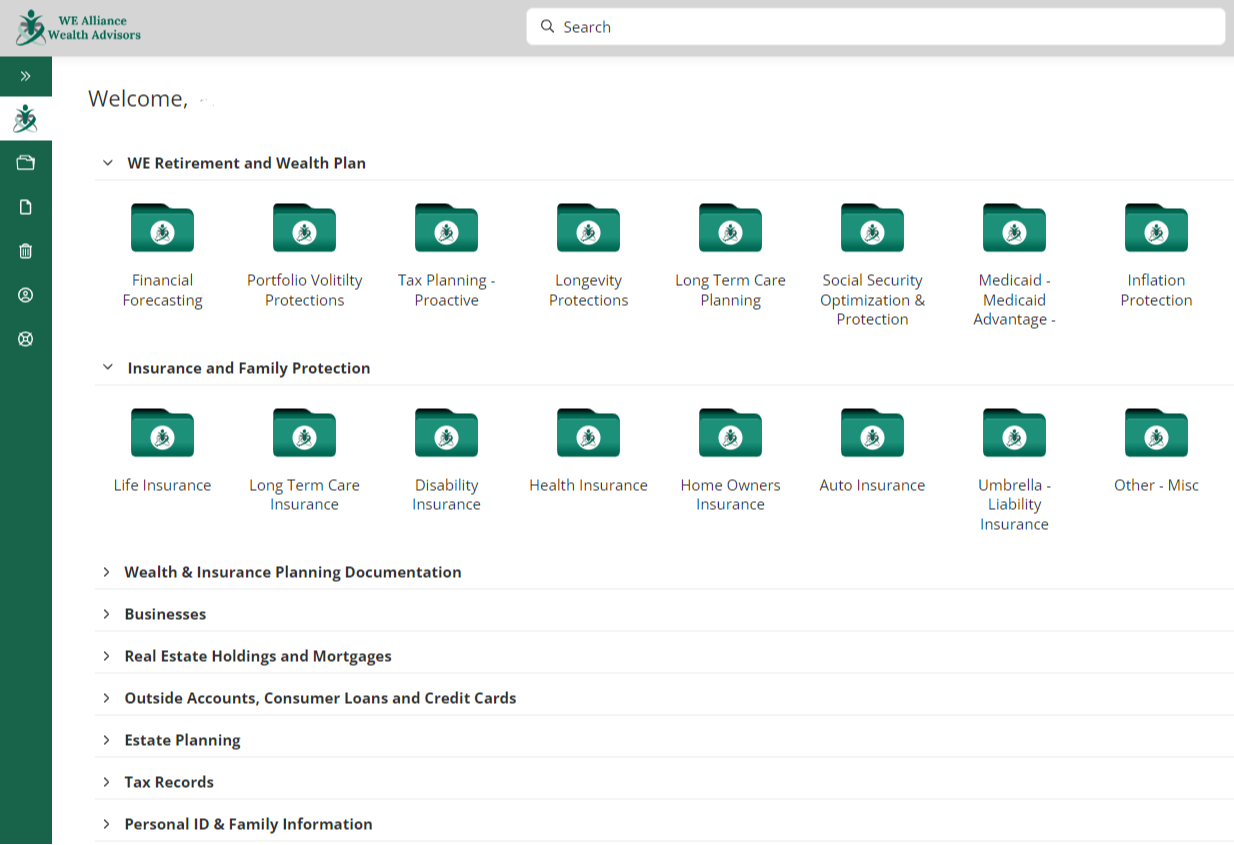

Introducing your WE Alliance Wealth Vault:

If something were to happen, would your spouse, family, or loved ones know how to carry out your carefully crafted planning?

All too often, families are left scrambling, woefully unprepared to step into your shoes to implement your planning.

But for WE Alliance clients, our innovative Wealth Vault and "One Page Plan" process summarizes each key area of your plan, so your family can easily access the way you’ve prepped for

- Volatile markets

- Your proactive tax strategies

- Protection from outliving your money

- Plans for social security

- Long term care plans

- Estate planning

- And more

Access your WE Alliance Wealth Vault by becoming a client today.

3001 Douglas Blvd, Suite 142 • Roseville, CA 95661 • Toll Free: 800.355.8174 • Local: 916.325.0130 • Fax: 916.771.4475

Form ADV Part 3 - Client Relationship Summary • Privacy Policy

Securities and Advisory Services offered through WE Alliance Wealth Advisors, Inc., a Registered Investment Advisor.

CA Insurance License #0A89858

Disclosure

WARRANTIES & DISCLAIMERS There are no warranties implied.

WE Alliance Wealth Advisors, Inc. is a registered investment adviser located in Roseville, CA. WE Alliance Wealth Advisors, Inc. may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. WE Alliance Wealth Advisors, Inc.’s web site is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Accordingly, the publication of WE Alliance Wealth Advisors, Inc.’s web site on the Internet should not be construed by any consumer and/or prospective client as WE Alliance Wealth Advisors, Inc.’s solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet. Any subsequent, direct communication by WE Alliance Wealth Advisors, Inc. with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of WE Alliance Wealth Advisors, Inc., please contact the state securities regulators for those states in which WE Alliance Wealth Advisors, Inc. maintains a registration filing. A copy of WE Alliance Wealth Advisors, Inc.’s current written disclosure statement discussing WE Alliance Wealth Advisors, Inc.’s business operations, services, and fees is available at the SEC’s investment adviser public information website – www.adviserinfo.sec.gov or from WE Alliance Wealth Advisors, Inc. upon written request. WE Alliance Wealth Advisors, Inc. does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to WE Alliance Wealth Advisors, Inc.’s web site or incorporated herein, and takes no responsibility therefor. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. This website and information are provided for guidance and information purposes only. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy. This website and information are not intended to provide investment, tax, or legal advice.